Kensington has been an active investor in venture capital since the launch of the firm in 1996, with strong links across all major markets in the United States and Canada.

Kensington is currently investing in venture as one of the three core strategies of our Kensington Private Equity Fund, which remains open to new investors. We also manage three standalone venture funds that are closed to new investors: Kensington Venture Fund, Kensington Venture Fund II and BC Tech Fund.

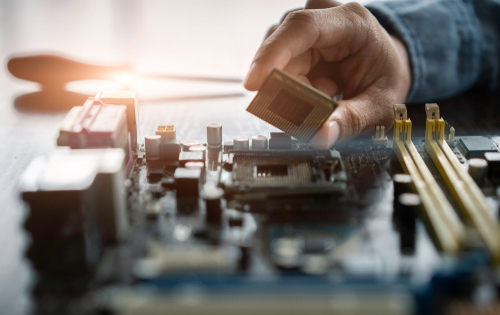

Kensington pursues a diversified investment strategy across the venture capital market. We invest across all stages from early-stage Seed and Series A through later stage technology growth companies. Our hybrid strategy includes direct investments in emerging technology companies as well as investments into venture capital funds. This approach provides us with a broadly diversified portfolio covering all key subsectors, including information and communications technology, life science/healthcare, energy and sustainability technologies, digital media, cybersecurity, robotics and tech-enabled services such as e-commerce, telemedicine and online education. We invest primarily in funds and companies based across Canada and the United States, acting as lead investors or as supporting members of a syndicate.

Kensington Venture Fund II

BC Tech Fund

Kensington Venture Fund

Learn about our dedicated team of professionals.